The market is SHIFTING, not crashing

Quarter three of 2022 has kicked off with some dramatic changes to the Central Florida Real Estate Market and experts are forecasting the current market growth is going down in comparison to last year. Interest rates are still substantially rising, however the prices of homes are not increasing as quickly as they have been in the past year.

What do all of these stats mean? We know it can be overwhelming, which is why we are taking a step back and looking at the bigger picture.

Keep reading for more details on Central Florida's real estate market, with a focus on Orlando, Kissimmee, Sanford, DeLand, Daytona Beach, Deltona, Ormond Beach, The Villages, Clermont, Mount Dora and Tavares.

.jpg?width=620&height=349&name=August%202022%20-%20Company%20Wide%20Meeting%20(6).jpg) Central Florida Real Estate sales are slowing down

Central Florida Real Estate sales are slowing down

The boiling question that a lot of homeowners, buyers and investors have is: are we going to see another crash? All data points to NO! Although closed sales transactions are dropping (down 24.3% last month alone), if you track sales from the pre-pandemic market to date, you will see sales still trending upward.

According to Experts and our Preferred Lenders at Lendello Mortgage, Erin Morris and Matt Denny:

"The market continues to absorb the impact of the large prices and increased rates that led to the decline in affordability. As a result they expect purchase demand to continue to decline. Supply will modestly increase. Home price growth will decelerate. Mortgage rates are still moving and people are still buying houses..."

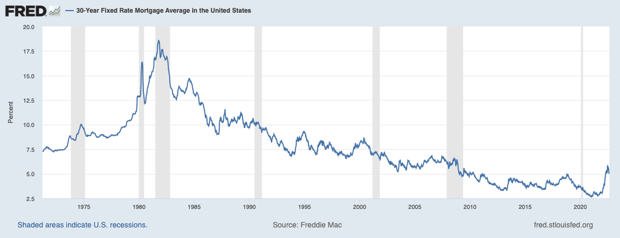

We expect the purchase demands to drag like they have within these past few months. It seems like the rates have been drastically higher, but if you look at historical data dating back to 22 years ago the mortgage rates are still lower with the current trends.

In regards to the graph below we have obtained this information through Fred, which contains consistent and accurate economic data that can be helpful to anyone that is looking to invest, buy or sell their property. As you can see in the graph, the 30-Year Mortgage rates, in comparison to historic data, are still substantially low. The current mortgage rates are fluctuating a lot and they're staying in the 5-6% range.

Home prices are still climbing steadily in Florida

According to Florida Realtors Annual Market Report, single-family home prices increased by 16.1% in 2021, showing that the price of houses are still consistently staying higher than usual. Just because home prices aren't climbing as high as they were recently, doesn't mean they are not still on the rise! They are...

From July last month in comparison to last year, the average sale price up at least 12.0% across Central Florida in the month of July. Even looking at the increase from last month to now, we're seeing a 17.9% increase in sales prices.

Have you checked the value of your home lately? Click here now to see if it's worth it to sell if you're currently a homeowner.

As you can see in the graph above, the percentage of increase in average sales price has maintained a steady climb for the last several years. This is a great sign of a strong sellers market. Month to month changes are expected, which is why we take a step back and look at the bigger picture for a true sense of the market.

Buyers waiting for the market to drop: looks like it's not going to!

The Central Florida Market in regards to the Inventory (Active Listings) vs Pending Inventory are polar opposite and the Percent Change Year-over-Year will show you how.

To start off, Inventory (Active Listings) is significantly high at 67.5%, while Pending Inventory is down -18.4% in comparison to last year. This shows that there is an opportunity to be able to have access to more properties, and in turn better options for home-buyers.

According to Gus Grizzard Broker/Owner of ERA Grizzard Real Estate:

According to Gus Grizzard Broker/Owner of ERA Grizzard Real Estate:

"Yes the market is shifting, but it is still a strong seller's market. Don't wait for prices to drop because you might end up paying more with interest rates trending up".

Sellers have more competition

Interestingly enough, Active Inventory is substantially growing - almost doubling over the last 4 months. In comparison to last year, we're seeing an increase of 80.5%. The spike in inventory is giving buyers more options, and at the same time creating increased competition for potential sellers.

.jpg?width=620&name=August%202022%20-%20Company%20Wide%20Meeting%20(9).jpg)

Homes are staying on the market slightly longer

The Average Days on the Market for single-family homes currently is at 48 days in Central Florida, higher than it's been in a few months, but still not a dramatic change suggesting any kind of crash. In fact, as you can see in the chart below, we are getting back to pre-pandemic figures. The market is just normalizing as it levels back out.

Should I still sell in this market?

Potential sellers are asking themselves this question in this current market... Is it still a good time to sell? Absolutely! The data is still showing high demand on both sides! It's never been more important to price your home accurately though, since there is more competition on the market.

According to the July 2022 data, the number of closed homes in comparison to this time last year is down -22.9% with the median sales price being 16.1% over the market. The average sale price remains high, showing potential buyers are still willing to pay for the right home - if they can find it.

Buyer and Seller takeaways

After consulting our Broker/Owner, Gus Grizzard, as well as our Preferred Lending Experts at Lendello Mortgage, Erin Morris and Matt Denny, we've learned a lot!

These are the key points buyers and sellers should keep in mind in today's real estate market:

- Don't get caught up in headline news that the market is collapsing... it's not, it's just correcting!

- The percentage change in the number of closed transactions might be down compared to last year, but keep in mind the percentage of increase last year was huge and unprecedented.

- The market continues to absorb the impact of the large prices and increased rates that led to the decline in affordability.

- Buyer demand is softening - no longer flooding new listings with offers above asking price, buyers are taking their time to shop around.

- As a result, we expect purchase demand to continue to normalize. This will mean longer days on the market.

- Supply will modestly increase as more homeowners continue to list their properties for sale, providing more competition on the market for sellers.

- Home price increase is slowing down, but prices are still steadily rising.

- Mortgage rates are still moving and people are still buying houses, but as a result of higher interest rates it means that potential buyers are losing buying power.

Buyers: don't wait for the prices to drop because you may end up paying even more with the interest rates rising!

Sellers: Pricing your home for the market is critical! Trust your Realtor® as they prepare your CMA and guide you through the sale of your home.

.jpg?width=618&name=August%202022%20-%20Company%20Wide%20Meeting%20(7).jpg)

-jpg.jpeg)