We're entering quarter three and experts are forecasting the current market growth is going down in comparison to last year. Interest rates are projected and showing with statistics that they're substantially rising, however the prices of homes are not increasing as quickly as they have been in the past year. Keep reading for more details on Florida's real estate market, with a focus on Orlando, Kissimmee, Sanford, DeLand, Daytona Beach, Deltona, Ormond Beach, The Villages, Clermont, Mount Dora and Tavares

Mortgage Rates are continuing to rise..

The churning question that a lot of home-buyers and investors have is what are the current mortgage rates looking like.

According to Experts and our Preferred Lenders at Lendello Mortgage, Erin Morris and Matt Denny, the Mortgage Rates are continuing to consistently be on the rise.. So what does this mean for home buyers? You guessed right it's going to mean lower buying power and higher mortgage payments. We have obtained this information through Fred, which contains consistent and accurate economic data that can be helpful to anyone that looking to invest, buy or sell their property.

In regards to the graph below this depicts of the 30 Year Fixed Rate Mortgage Average in the United States. As you can see in the short term aspect - the percent rate in comparison to this time last year 2021 has doubled from 2.5% to currently around 5%.

Home prices remain high in Florida

According to Florida Realtors Annual Market Report, single-family home prices increased by 15.6% last year, this statistic shows that the price of houses are still consistently staying higher than usual. From May last month in comparison to last year, home prices still remain high, with the average sale price up at least 12.8% across Central Florida in the month of April. We’ll dive deeper into some region-specific numbers in a moment.

Have you checked the value of your home lately? Click here now to see if it's worth it to sell if you're currently a homeowner.

Purchase Power vs Interest Rates

Purchase Power at the beginning of January 2022 was $415,000 in comparison to recently going down April 2022 being $331,000 - that is a huge jump in only 3 months! This means that buyers are getting less purchase power and they're not going to be able to get a bang for their buck as much as they could back in the day, but demand is still high!

According to our Preferred Lenders at Lendello Mortgage, Erin Morris and Matt Denny, there is a high possibility that the interest rates could reach 7% by the end of 2022. In reference to interest rates they are up 5.11% in April in comparison to January 2022 being at 3.22%. showing that the interest rates are increasing at a fast pace.

With interest rates going up this is the perfect time to get a buyer that has been on the fence to put an offer in before they are priced out of the market.

The shift is getting bigger!

The Florida Market in regards to the Inventory (Active Listings) vs Pending Inventory are polar opposite and the Percent Change Year-over-Year will show you how.

To start off, Inventory (Active Listings) is significantly high at 31.5%, while Pending Inventory is down -13.1% in comparison to last year. This shows that there is an opportunity to be able to have access to more properties and in turn better options for home-buyers.

According to Gus Grizzard Broker/Owner of ERA Grizzard Real Estate "Even though we are seeing and reading stats are down compared to last year it is important to remember that last year was a record year and even though we are down…it will still be a good year for sellers and the market in general". This important to notate moving forward to not get discouraged with the stats being down.

Interestingly enough, Months Supply of Inventory is substantially going through the roof in comparison to last year showing an increase of 27.3% Percent Change-over-Year with Months Supply Inventory (MSI) being at 1.4 in May 2022. Gus Grizzard mentioned: "Last Spring I said it was the top of the sellers market, demonstrated by MSI that has been flat for the last 12 months. Now with interest rates and inflation we are seeing that shift occurring now."

The Median Time to Contract has 0.0% change compared to this time last year at 9 days, in comparison to the Median Time to Sale being down -9.4% at 48 Days. The number of Closed Cash Sales are up 4.9% in comparison to last year.

Should I still sell in this market?

Potential sellers are asking themselves this question in this current market.. Is it still a good time to sell? Absolutely! The data is still showing high demand on both sides and this going into Supply and Demand that we learned back in school.

According to the May 2022 data, the number of closed homes in comparison to this time last year is down -6.9% with the median sales price being 21.8% over the market. The average sale price remains high in each MSA, showing potential clients are still willing to pay for the right home - if they can find it.

In short, yes. But there’s more to it than that. The latest data shows the demand is certainly still there and the number of new listings are starting to rise showing that individuals are more swayed in selling their property.

According to the data, the number of closed home sales are down Florida’s MSAs compared to the same time last year. Again, the average sale price remains way up in each MSA, showing clients are still willing to pay for the right home – if they can find it.

The specifics...

That was an overall review of Florida’s real estate market for June 2022, but let’s take a deeper dive into the numbers for the Central Florida region specifically.

Florida vs. Central Florida

Now that we’ve discussed a recap of Florida’s real estate market in 2022, let’s take a look at how we closed out the year in our Central Florida markets, specifically.

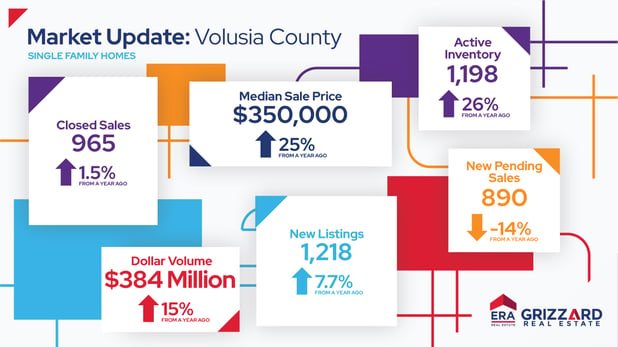

DeLand, Daytona Beach, Deltona & Ormond Beach Real Estate Market Update

The DeLand, Daytona Beach, Deltona and Ormond Beach MSA saw a 1.5% increase in the number of closed sales for May, with 965 closed sales, compared to the same time last year. The number of new pending sales is significantly down -14% from last year, with only 890 pending sales for the month.

Despite the number for new pending sales. there are about 7.7% more new listings this May compared to last, dollar volume is up 15% up in the MSA, with roughly $384 million, according to the latest numbers. Active inventory is up 26% from last year.

As far as pricing goes in these areas, the median sale price is up 25%, equating to $350,000.

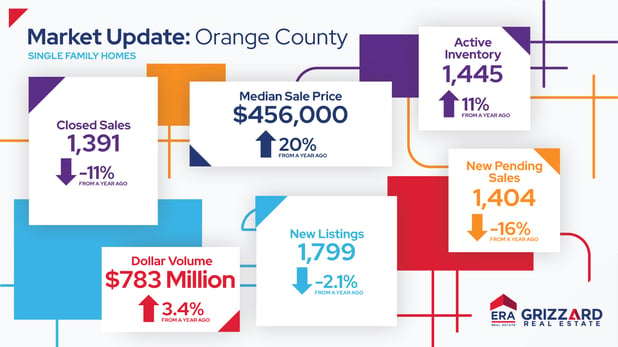

Orlando, Kissimmee & Sanford Real Estate Market Update

The Orlando, Kissimmee and Sanford MSA saw 1,391 closed sales for the month of May, which is down 11% from the same time last year. The area also saw 1,404 new pending sales in January, which is down by 16% from a year ago.

Inventory is gradually going down in those areas, with 1,799 new listings in May 2022. That’s -2.1% less listings than March of last year, according to the data. Still, though, the Orlando - Kissimmee - Sanford MSA’s dollar volume is steadily up 3.4% from this time last year, with $783 Million up from a year ago. Active inventory is also up in the area by 11% from the same time last year.

When it comes to pricing, the cost of a house in this MSA remains up, with a median sale price of $456,000, which is up 20% from a year ago.

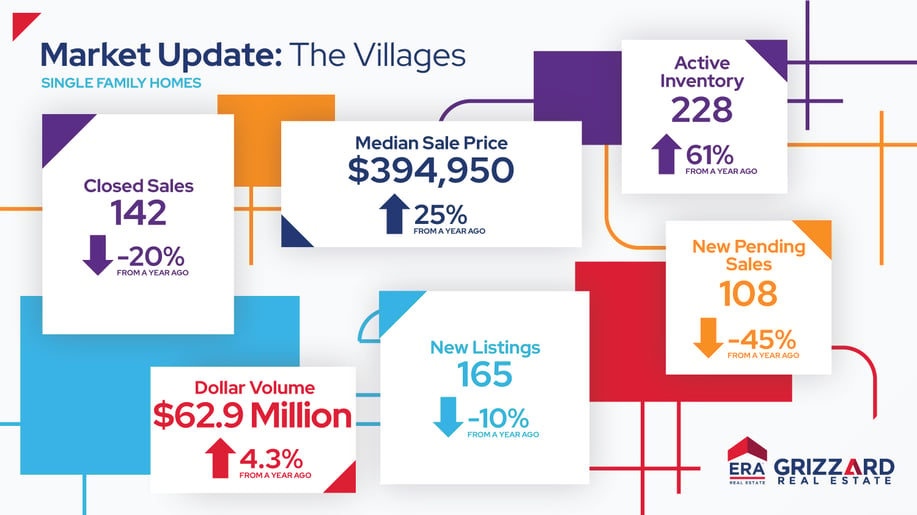

The Villages, Florida Real Estate Market Update

The Villages MSA is still down in the number of closed sales for May with a total of 142, which is 20% less than the same time last year. The number of new pending sales went down significantly by 45% from a year ago, with 108 new pending sales.

Compared to last year, The Villages, Florida, is also seeing an increase in dollar volume. The latest numbers show dollar volume up by 4.3%, which equates to $62.9 Million Dollars. Active inventory is up by nearly half compared to the same time last year. The number of new listings are significantly down -10% in March to comparison to last year, with a total of 165.

The average median sale price of a home in The Villages, Florida, according to the latest data, is just over $394,950, up 25% from a year ago.

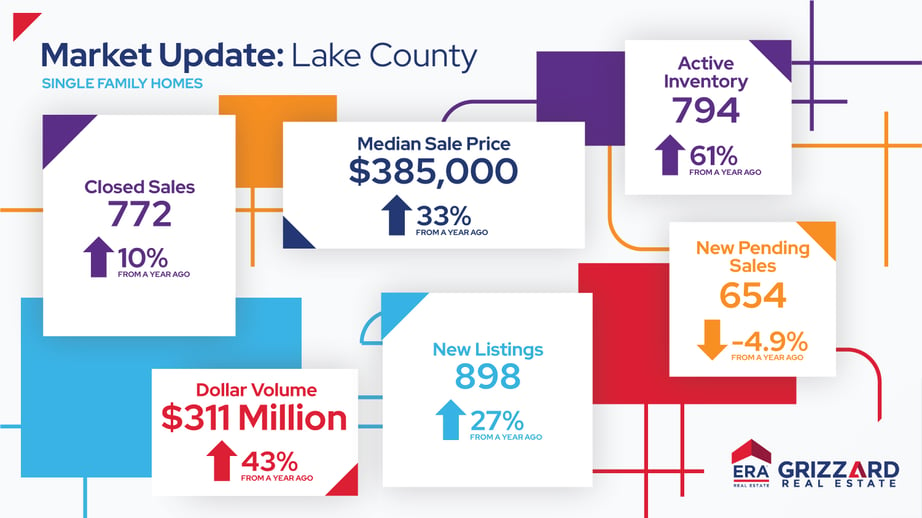

Clermont, Mount Dora and Tavares, Florida Real Estate Market Update

The Clermont, Mount Dora and Tavares MSA actually saw a 10% increase in the number of closed sales for May, with 722 closed sales, compared to the same time last year. The number of new pending sales went down -4.9% from last year, with roughly 654 pending sales for the month.

Despite having 27% more new listings this May compared to last, dollar volume remains up 43% in the MSA, with $311 Million dollar volume the same time last year, according to the latest numbers. Active inventory is significantly up 61% from last year.

As far as pricing goes in these areas, the median sale price remains significantly up 33%, which equates to $385,000.