Experts are forecasting the current market growth to slow as we get into the second half of 2022. Interest rates are projected to continue rising, however the prices of homes are not increasing as quickly as they have been. Keep reading for more details on Florida's real estate market, with a focus on Orlando, Kissimmee, Sanford, DeLand, Daytona Beach, Deltona, Ormond Beach, The Villages, Clermont and Tavares

Home prices remain high in Florida

According to Florida Realtors Annual Market Report, single-family home prices increased by 21.8% last year, a notable statistic for anyone considering selling their home in the near future. Now, even in 2022, home prices remain high, with the average sale price up at least 12.8% across Central Florida in the month of April. We’ll dive deeper into some region-specific numbers in a moment.

Have you checked the value of your home lately? You may want to.

The shift has begun!

Currently in the Florida Market the Inventory (Active Listings) vs Pending Inventory are on two opposite spectrums in regards to Single-Family Homes.

To start off, Inventory (Active Listings) is 6.9% higher, with Pending Inventory being -13.3% in comparison to last year. So what exactly does this mean? Active is when a property is available for sale (not under contract) and Pending is when the property is under contract.

On the flip-side, the Median Time to Contract is down -27.3% compared to last year, while Median Time to Sale is down -12.7%. According to The Florida Realtors "When the gap between Median Time to Contract and Median Time to Sale grows, it is usually a sign of longer closing times and/or declining number of cash sales". Cash Sales have declined slightly to -1.5% in comparison to last year - So what does this mean for you? This is a small number, but these statistics are showing that non-cash buyers are potentially going to have a better fighting chance in the near future to secure their dream home.

Buyer demand is high, inventory remains low

Housing inventory remains low in Florida, according to the latest data. According to Florida Realtors, inventory falls when new listings aren't keeping up with the rate at which homes are going off-market.

How low is inventory right now? Well, month supply is the best indicator of seller and buyer demand. Six months inventory is considered normal, and, according to the latest numbers, Central Florida Metropolitan Statistical Areas have about one month of inventory – some with even less than that – compared to the same time the previous year, when there was more than one month’s supply in Central Florida’s MSAs. Active inventory is significantly lower in Central Florida MSAs for February than it was for the same time last year.

The data makes it clear there are still not enough houses to meet buyers’ demands.

The number of new listings may be bringing some relief to the inventory issue, though, since that number is up in some places, but not by much. In other Central Florida spots, the number of new listings is down compared to the same time last year.

Should I still sell in this market?

The big question: Is it still a good time to sell? Yes of course. The data shows the demand is still there on both sides. This goes into the Law of Supply and Demand - the less inventory that is available the more buyers want in on the action.

According to the April 2022 data, the number of closed homes in comparison to this time last year has gone down 15% with the median sales price being 21.5% over the market. The average sale price remains high in each MSA, showing potential clients are still willing to pay for the right home - if they can find it.

In short, yes. But there’s more to it than that. The latest data shows the demand is certainly still there, but it does make it harder to close more deals with fewer options on the market. Remember that whole “supply and demand” thing we learned about as kids?

According to the data, the number of closed home sales was either down in Central Florida’s MSAs compared to the same time last year, or just slightly up, as was the number of pending sales. Again, the average sale price remains way up in each MSA, showing clients are still willing to pay for the right home – if they can find it.

The specifics...

That was an overall review of Florida’s real estate market for April 2022, but let’s take a deeper dive into the numbers for the Central Florida region specifically.

Florida vs. Central Florida

Now that we’ve discussed a recap of Florida’s real estate market in 2022, let’s take a look at how we closed out the year in our Central Florida markets, specifically.

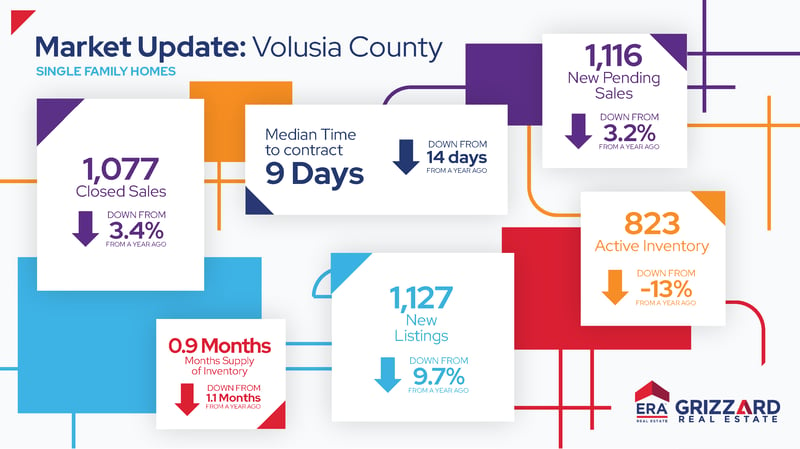

DeLand, Daytona Beach, Deltona & Ormond Beach Real Estate Market Update

The DeLand, Daytona Beach and Ormond Beach MSA actually saw a 3.4% increase in the number of closed sales for March, with 1,077 closed sales, compared to the same time last year. The number of new pending sales was also up 3.2% from last year, with more than 1,116 pending sales for the month.

Despite having 9.7% more new listings this March compared to last, inventory is still down in the MSA, to a one month supply, compared to 1.1 months the same time last year, according to the latest numbers. Active inventory is down -13% from last year.

As far as pricing goes in these areas, the average sale price of a home is $288,235, up 20.1% from last April.

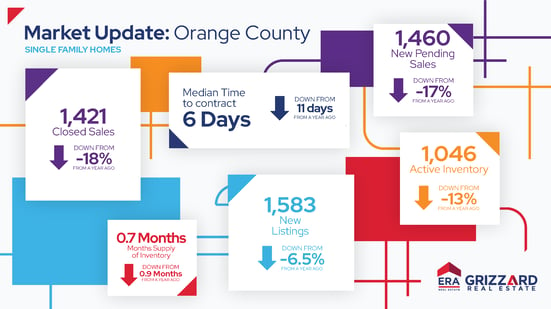

Orlando, Kissimmee & Sanford Real Estate Market Update

The Orlando, Kissimmee and Sanford MSA saw 1,421 closed sales for the month of February, which is down 18% from the same time last year. The area also saw 1,460 new pending sales in January, which is down by 17% from a year ago.

Inventory is gradually going down in those areas, with 1,583 new listings in March 2022. That’s -6.5% less listings than March of last year, according to the data. Still, though, the Orlando - Kissimmee - Sanford MSA’s inventory remains critically low, with only 0.7 months worth of inventory, down from 0.9 months worth of inventory the same time last year. Active inventory is also down in the area by -13% from the same time last year.

When it comes to pricing, the cost of a house in this MSA remains up, with an average sale price of $350,173, up 14.8% from a year ago.

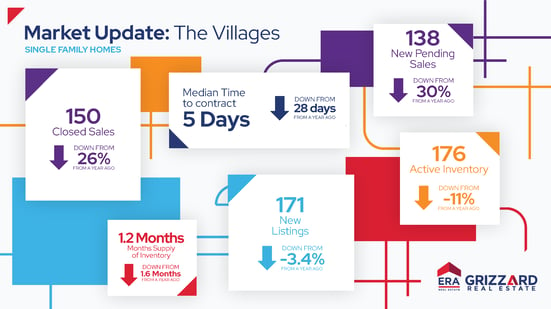

The Villages, Florida Real Estate Market Update

The Villages MSA saw a more significant drop in the number of closed sales for March with a total of 150, which is 26% less than the same time last year. The number of new pending sales was also down by 30% from a year ago, with 138 new pending sales.

Compared to last year, The Villages, Florida, is also seeing a significant drop in housing inventory. The latest numbers show a one-month supply of inventory, down from 1.6 months worth of inventory the same time last year. Active inventory is down by nearly half compared to the same time last year. The number of new listings are significantly down -3.4% in March to comparison to last year, with a total of 171.

The average sale price of a home in The Villages, Florida, according to the latest data, is just over $389,500, up 32% from a year ago.

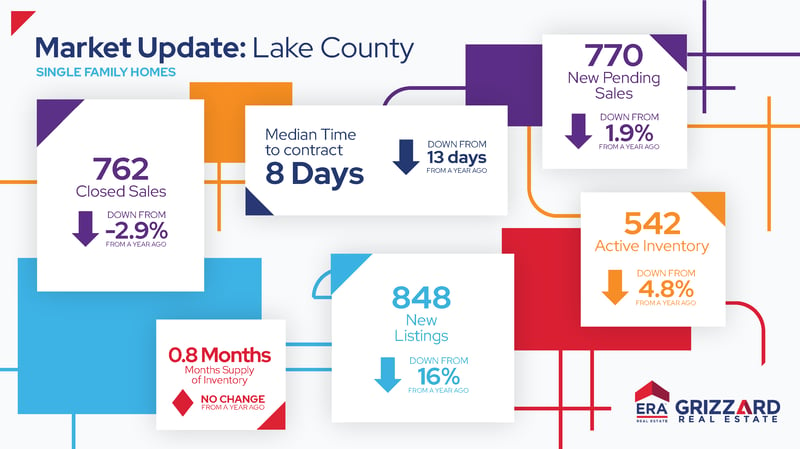

Clermont and Tavares, Florida Real Estate Market Update

The Clermont and Tavares MSA actually saw a -2.9% decrease in the number of closed sales for March, with 762 closed sales, compared to the same time last year. The number of new pending sales went up 1.9% from last year, with more than 770 pending sales for the month.

Despite having 16% more new listings this March compared to last, inventory still remains the same in the MSA, compared to .08 months the same time last year, according to the latest numbers. Active inventory is significantly up 4.8% from last year.

As far as pricing goes in these areas, the average sale price of a home is $330,026, up 24.1% from last April.